straight life policy formula

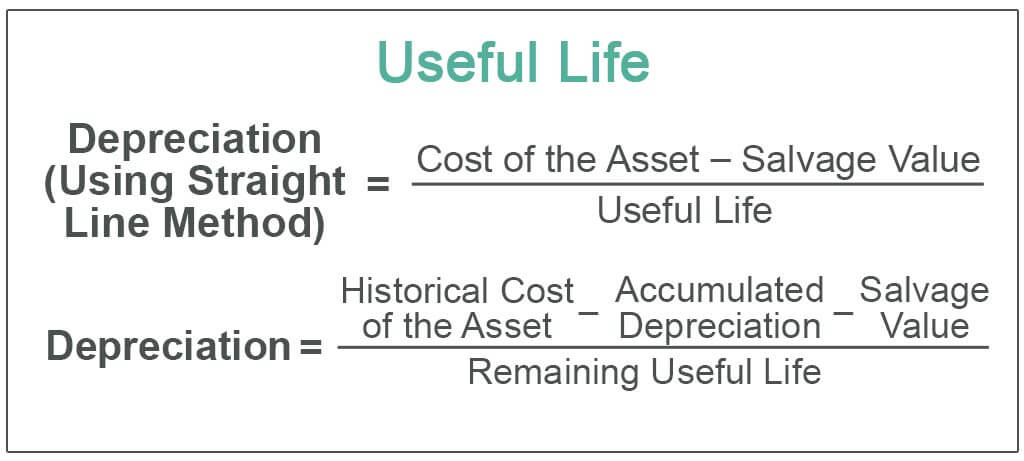

The useful life of the assethow many years you think it will last. Book value residual value X depreciation rate Where.

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Expense Cost Salvage ValueUseful life.

:max_bytes(150000):strip_icc()/LinearRelationshipDefinition2-a62b18ef1633418da1127aa7608b87a2.png)

. Ad Shop Plans From The Nations Top Life Insurance Providers. On the death of the retiree the monthly payments end. This includes your premium payments insurer policies type of policy and loan balances.

Updated Oct 15 2021. The straight life option pays a monthly annuity directly to the retiree for life. The number of years that company expects to use an asset.

The expected present value of 1 one year in the future if the policyholder aged x is alive at that time is denoted in older books as nEx and is called the actuarial present value of a life-contingent. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance.

Straight life insurance is more commonly known as whole life insurance. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. Salvage value is the value of the asset at the end of its useful life.

Useful life of asset represents the number of periodsyears in which the asset is expected to be used by the company. A straight life insurance. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax.

While more expensive than term life insurance straight life insurance offers the opportunity to build cash value. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Premium formula namely the pure n-year endowment.

What type of premium does a straight life policy have. With the life expectancy of retirees continuing to lengthen having a guaranteed life. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax.

A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single lump-sum payment. Straight life is the simplest benefit option offered by APERS. 02 x 15 3.

Typically you buy one and make regular payments during your working life or pay a single lump sum usually after retirement. First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. When you make premium payments a portion of the payment is invested by your insurer.

Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. Decreasing term insurance is a type of renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. A whole life policy in which premiums are payable as long as the insured lives.

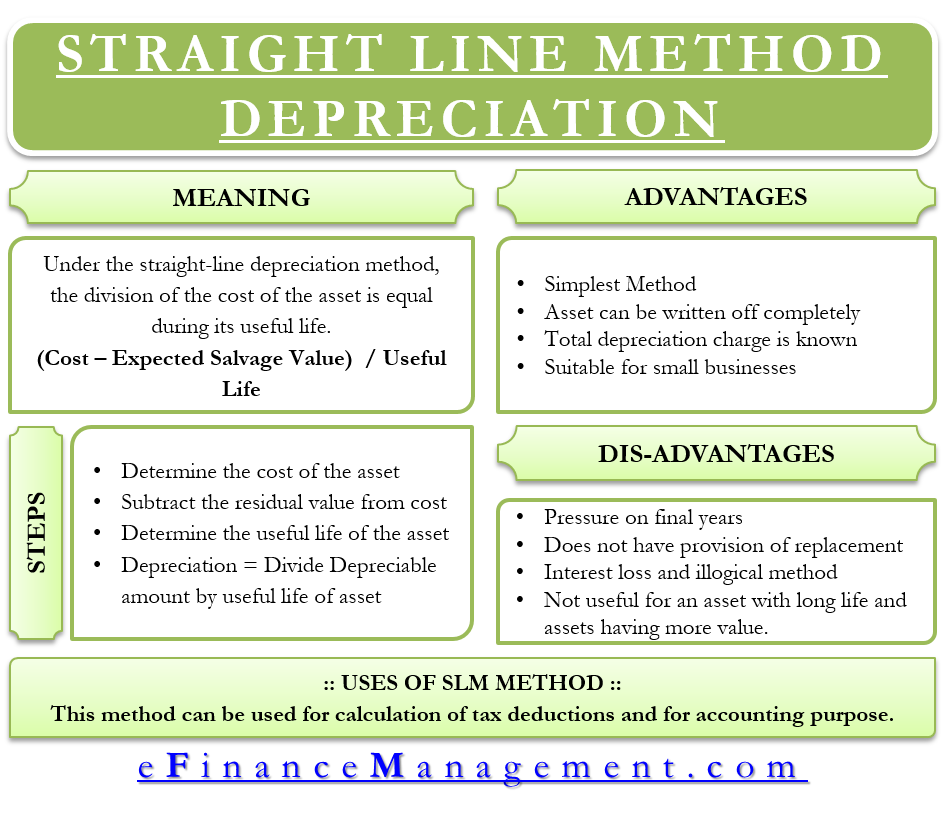

The formula for the straight-line depreciation method is quite straightforward to calculate. Our Agents Will Work with You to Customize a Policy that Fits your Unique Needs. 02 x 15 3.

The straight life annuity choice gives the retiree an income he cannot outlive. Cost of the asset is the purchase price of the asset. Like all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner.

Straight Line Depreciation Formula. 495 1660 Views. Final value residual value - The.

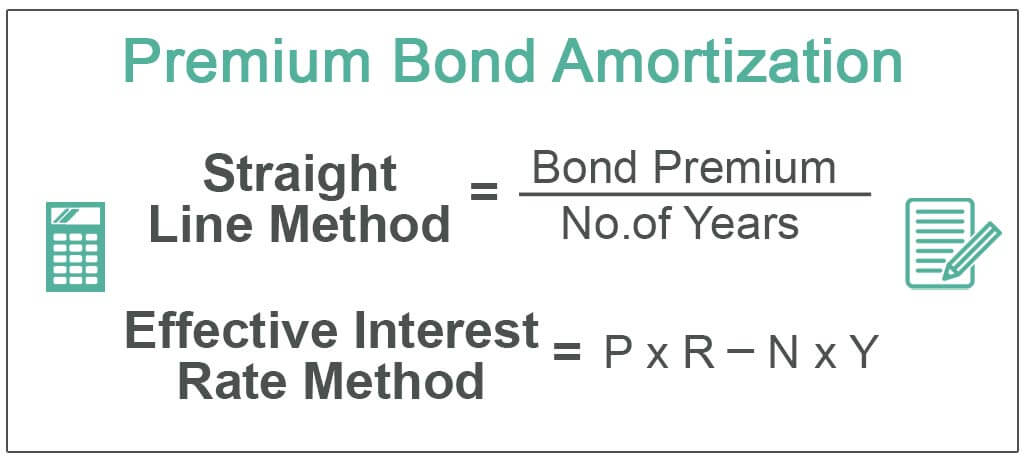

Both depreciation and amortization apply the same concept. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Our Simple Process Allows You To Shop Top Rated Insurers And Save In Minutes.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums. Your insurer usually invests the money in low-yield.

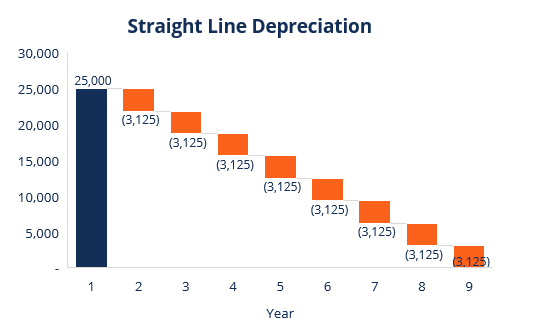

Unlike the other benefit options straight life has no provisions for extending annuity payments to a beneficiary or survivor for an exception see the section. What is Straight life. The depreciation amount is the same every year.

Number of children of the applicant. 35 Votes A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. This includes your premium payments insurer policies type of policy and loan balances.

Premiums are usually constant throughout the. Suppose an asset for a business cost 11000 will have a life of 5 years and a salvage value of 1000. Below is the explanation of the values that are required to add to the calculator for calculation.

The Straight Life Option. Straight-line Method Formula Depreciation Expense Cost Salvage ValueUseful life Cost. International Risk Management Institute Inc.

This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. Purchase price and other costs that are necessary to bring assets to be ready to use. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life.

For example if the rate is 02 per 1000 and an enrollee elects 15000 in coverage the monthly premium will be 3. To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get annual depreciation. The straight line depreciation formula for an asset is as follows.

Estimated assets value at the end of useful life. Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount. Compare Plans For Free Online.

Annual depreciation purchase price - salvage value useful life. Straight life policies are often expensive and therefore. Acquisition cost Salvage value Service life years.

Asset value - The original value of the asset for which you are calculating depreciation. February 27 2022. Balance Asset value - Depreciation value.

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax. Here are few things that you should know when you want to calculate cash value of life insurance. Upon death the payments stop and you cannot designate a beneficiary with this type of insurance.

Period - The estimated useful life span or life expectancy of an asset. Ad Put You and Your Loved Ones on a Path Toward Financial Preparedness for the Future. The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary depending on which factors influence it age gender etc.

Straight Line Depreciation Template Download Free Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Efinancemanagement

Depreciation Rate Formula Examples How To Calculate

Amortization Of Bond Premium Step By Step Calculation With Examples

Depreciation Formula Examples With Excel Template

Net Book Value Meaning Formula Calculate Net Book Value

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

:max_bytes(150000):strip_icc()/LinearRelationshipDefinition2-a62b18ef1633418da1127aa7608b87a2.png)

Linear Relationship Definition

Straight Line Depreciation Formula Guide To Calculate Depreciation

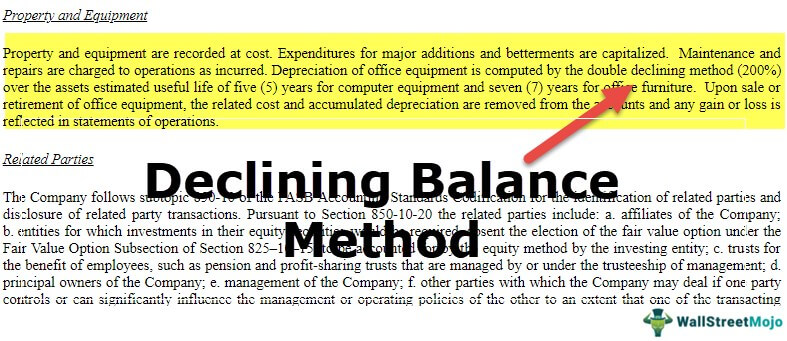

Double Declining Balance Method Of Deprecitiation Formula Examples

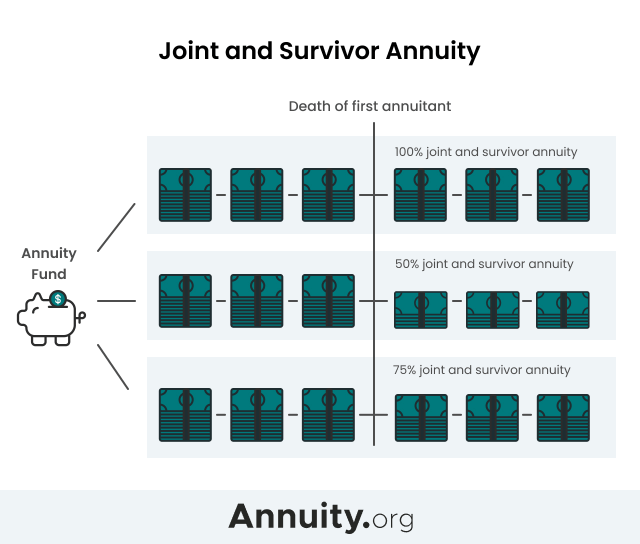

Joint And Survivor Annuity The Benefits And Disadvantages

Loss Ratio Formula Calculator Example With Excel Template